In the realm of small business, financial literacy empowers growth. While intricate spreadsheets may seem daunting, financial ratios simplify complex financial data into bite-sized, actionable insights. These ratios act as your financial compass, guiding you toward informed decisions and sustainable success.

Table of Contents

What is a Financial Ratio?

Imagine financial ratios as performance metrics condensing vast financial statements into digestible numbers. By comparing different financial statement elements, ratios reveal crucial aspects of your business health, like profitability, efficiency, and solvency.

Think of it this way: You wouldn’t judge a book by its cover, but glancing at its page count gives you a rough idea of its length. Similarly, financial ratios offer quick glimpses into your business’s financial story.

What is the Importance of Financial Ratios for Small Businesses?

For small businesses, navigating the financial landscape can be challenging. Financial ratios provide invaluable tools to:

- Assess your financial health: Identify strengths and weaknesses to make intelligent decisions about allocating resources, investments, and growth strategies.

- Benchmark against industry standards: Compare your ratios to competitors or industry averages to gauge your relative performance.

- Track progress over time: Monitor your ratios over months or years to identify trends, measure the effectiveness of financial decisions, and celebrate improvements.

- Secure funding: Investors and lenders often analyze financial ratios to assess your business’s creditworthiness and potential for success.

- Communicate financial health: Present clear and concise financial data using ratios to stakeholders, investors, and potential partners.

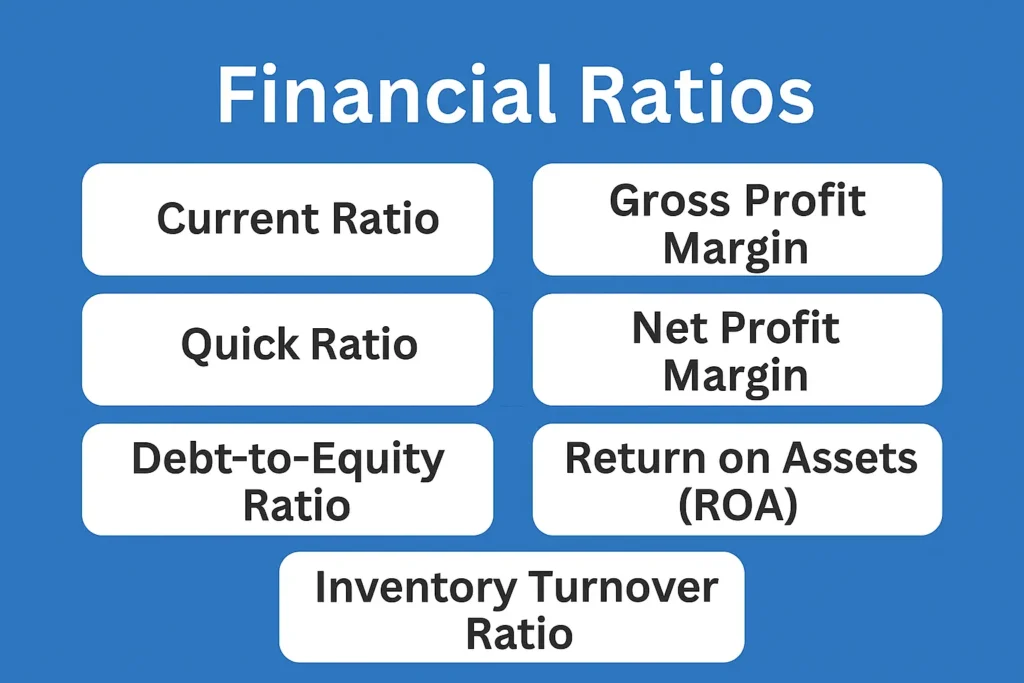

Most Common Financial Ratios with Calculations:

Let’s get into the financial ratios relevant to small businesses. Remember, these are just a few key examples, and the most relevant ratios will vary depending on your industry and business model.

Liquidity Ratios:

- Current Ratio: (Current Assets / Current Liabilities) – Measures your capabilities to meet short-term obligations (within a year) 2:1 is generally considered a healthy ratio.

- Quick Ratio: (Current Assets – Inventory / Current Liabilities) – A stricter measure of short-term liquidity, excluding less-liquid inventory. Aim for a quick ratio above 1.

Profitability Ratios:

- Gross Profit Margin: (Revenue – Cost of Goods Sold) / Revenue) x 100% – Indicates the percentage of revenue remaining after accounting for direct production costs. Industry benchmarks are crucial for comparison.

- Net Profit Margin: (Net Income / Revenue) x 100% – Reveals the percentage of revenue remaining after accounting for all expenses. A higher margin indicates better profitability.

Solvency Ratios:

- Debt-to-Equity Ratio: (Total Liabilities / Total Equity) – Measures your reliance on debt financing compared to owner investment. A lower ratio indicates more robust financial stability.

- Debt-to-Asset Ratio: (Total Liabilities / Total Assets) – Expresses the proportion of debt-financed assets. Industry benchmarks provide context for this ratio.

Efficiency Ratios:

- Inventory Turnover Ratio: (Cost of Goods Sold / Average Inventory) – Measures how efficiently you manage inventory. A higher ratio indicates faster inventory turnover and potentially reduced carrying costs.

- Accounts Receivable Turnover Ratio: (Net Credit Sales / Average Accounts Receivable) – Indicates how quickly you collect customer payments. A higher ratio suggests efficient collection practices.

Additional Ratios:

- Return on Investment (ROI): (Net Income / Investment) – Measures the return generated on a specific investment.

- Earnings per Share (EPS): (Net Income / Number of Outstanding Shares) – Indicates profitability per share of stock, relevant for publicly traded companies.

How to Use Financial Ratios:

Remember, financial ratios are valuable tools but shouldn’t be interpreted in isolation. Consider these factors:

- Industry benchmarks: Compare your ratios to relevant industry averages to understand your competitive standing.

- Trends over time: Track your ratios over several periods to identify trends and measure progress.

- Consider all financial data: Ratios provide snapshots, but analyzing complete financial statements paints a more comprehensive picture.

- Seek professional guidance: Consult a certified bookkeeper or accountant for personalized interpretation and strategic advice.

Conclusion:

Financial ratios are potent allies in your small business journey. By effectively understanding and leveraging these key metrics, you can get valuable insights, make informed, intelligent decisions, and navigate your path to sustainable success. Remember, consistent monitoring, ongoing analysis, and professional guidance are essential for unlocking the full potential of financial ratios for your unique business.

Frequently Asked Questions

1. Why are financial ratios important for small businesses?

Financial ratios provide insights into various aspects of your business’s financial health, helping you make informed decisions, identify trends, and attract investors.

2. How often should I review these financial ratios?

It’s advisable to review key financial ratios quarterly to stay informed about your business’s performance and make timely adjustments.

3. Can I calculate these ratios manually?

Yes, with accurate financial statements, you can calculate these ratios manually or use accounting software for efficiency.

4. What is a good current ratio for a small business?

A current ratio between 1.5 and 2 is generally considered healthy, indicating that there are sufficient assets to cover liabilities.

5. How can I improve my net profit margin?

Enhance your net profit margin by increasing revenue, reducing costs, optimizing pricing strategies, and improving operational efficiency.